Data Center Water Consumption in the US: Challenges, Trends, and Market Opportunities for 2025–2030

How the explosive growth of US digital infrastructure is reshaping water management—and what it means for utilities, technology providers, and investors.

Key Takeaways

- US data centers consumed 66 billion liters of water directly and 800 billion litersindirectly in 2023

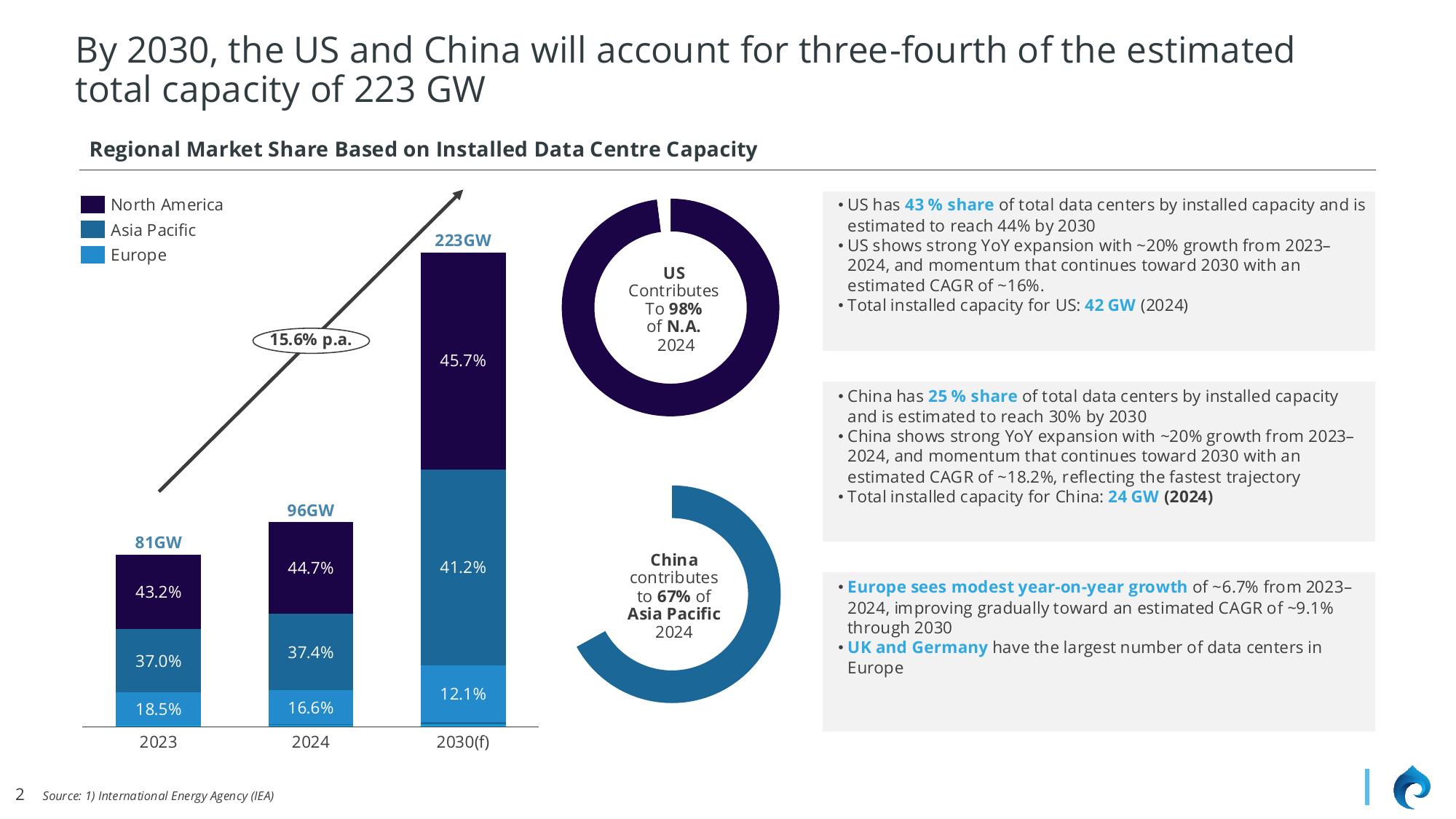

- The US holds 43% of global data center capacity, projected to grow at 16% CAGR through 2030

- California and Texas face the highest water stress from data center concentration

- Hyperscale facilities will consume 60–124 billion liters annually by 2028

- Water treatment equipment market growing at 12–15% CAGR through 2030

How Much Water Do Data Centers Use?

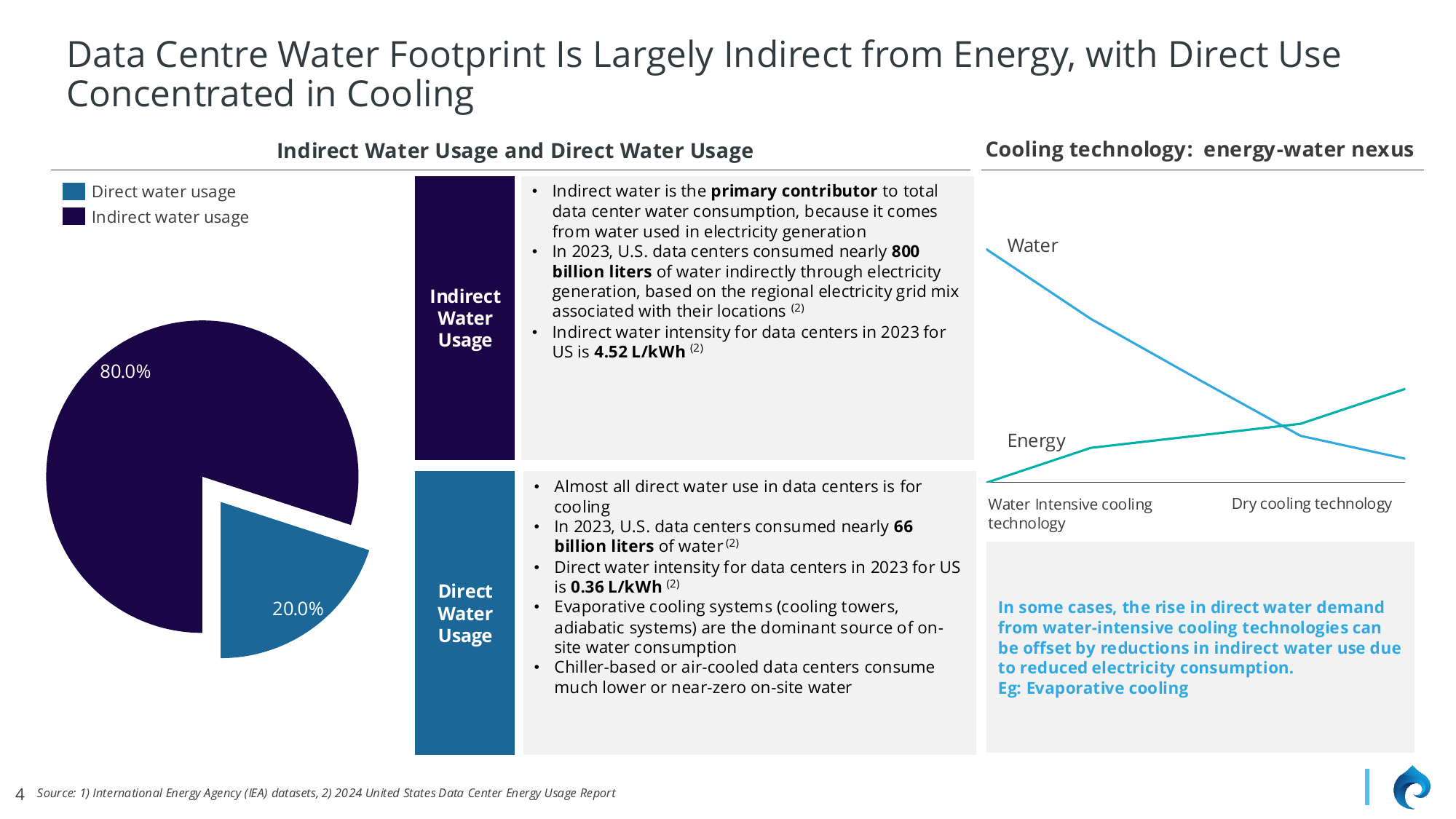

Data centers in the United States consumed approximately 66 billion liters of water directly in 2023, primarily for cooling operations. However, the total water footprint is far larger when accounting for electricity generation: US data centers consumed nearly 800 billion liters of water indirectly through the power grid in the same year.

This means roughly 80% of a data center’s water consumption is embedded in the electricity it uses, making the energy-water nexus critical to understanding the full environmental impact of digital infrastructure.

Why Is Data Center Water Usage Growing?

The United States stands at the center of a global data center expansion unlike anything we’ve seen before. With 43% of the world’s installed data center capacity and growth rates approaching 20% year-over-year, America’s digital infrastructure is scaling at a pace that carries profound implications for water resources.

Several factors are driving this growth:

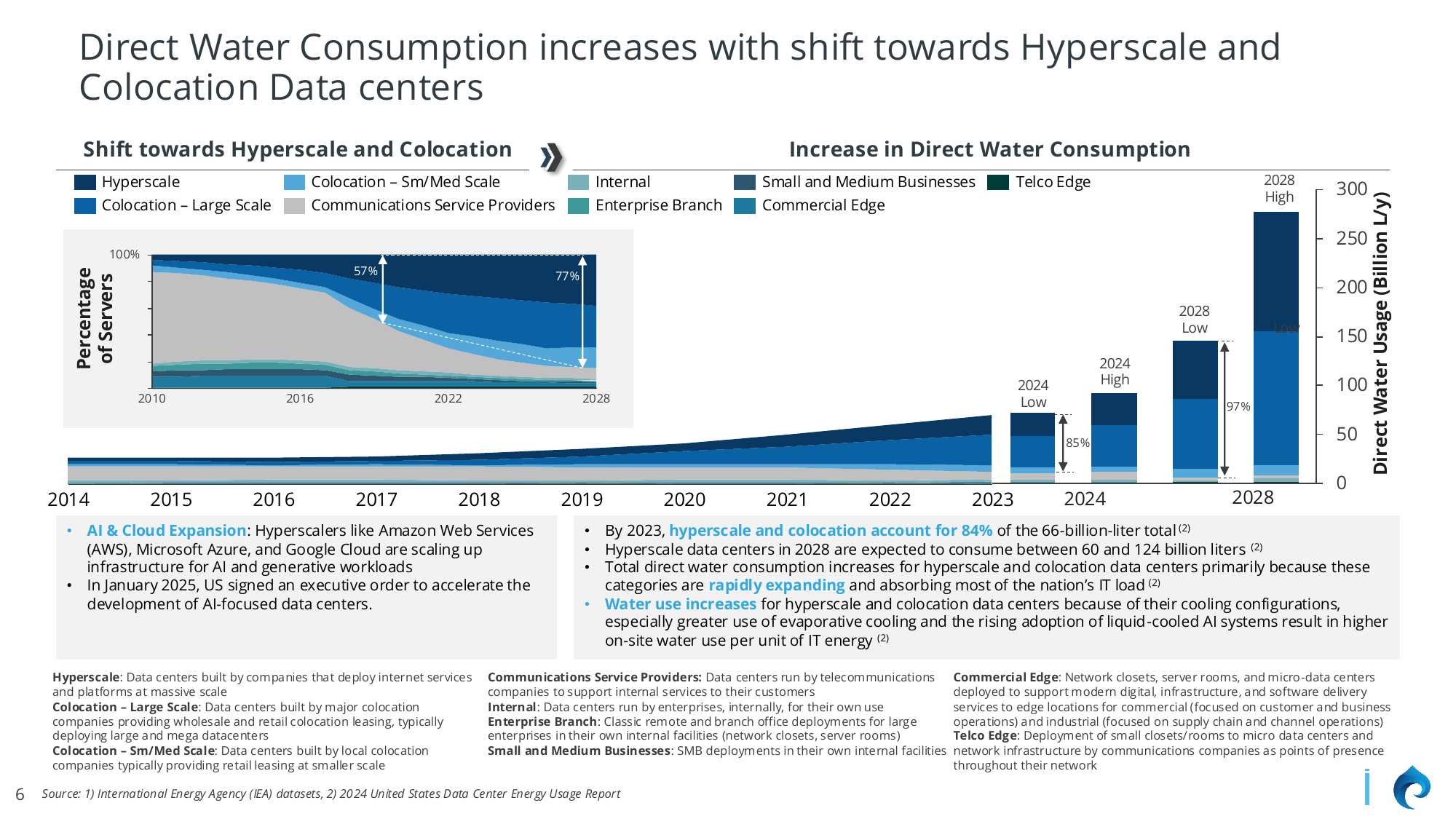

AI and cloud computing expansion. Hyperscalers like Amazon Web Services, Microsoft Azure, and Google Cloud are scaling up infrastructure for AI and generative workloads. In January 2025, the US signed an executive order to accelerate AI-focused data center development.

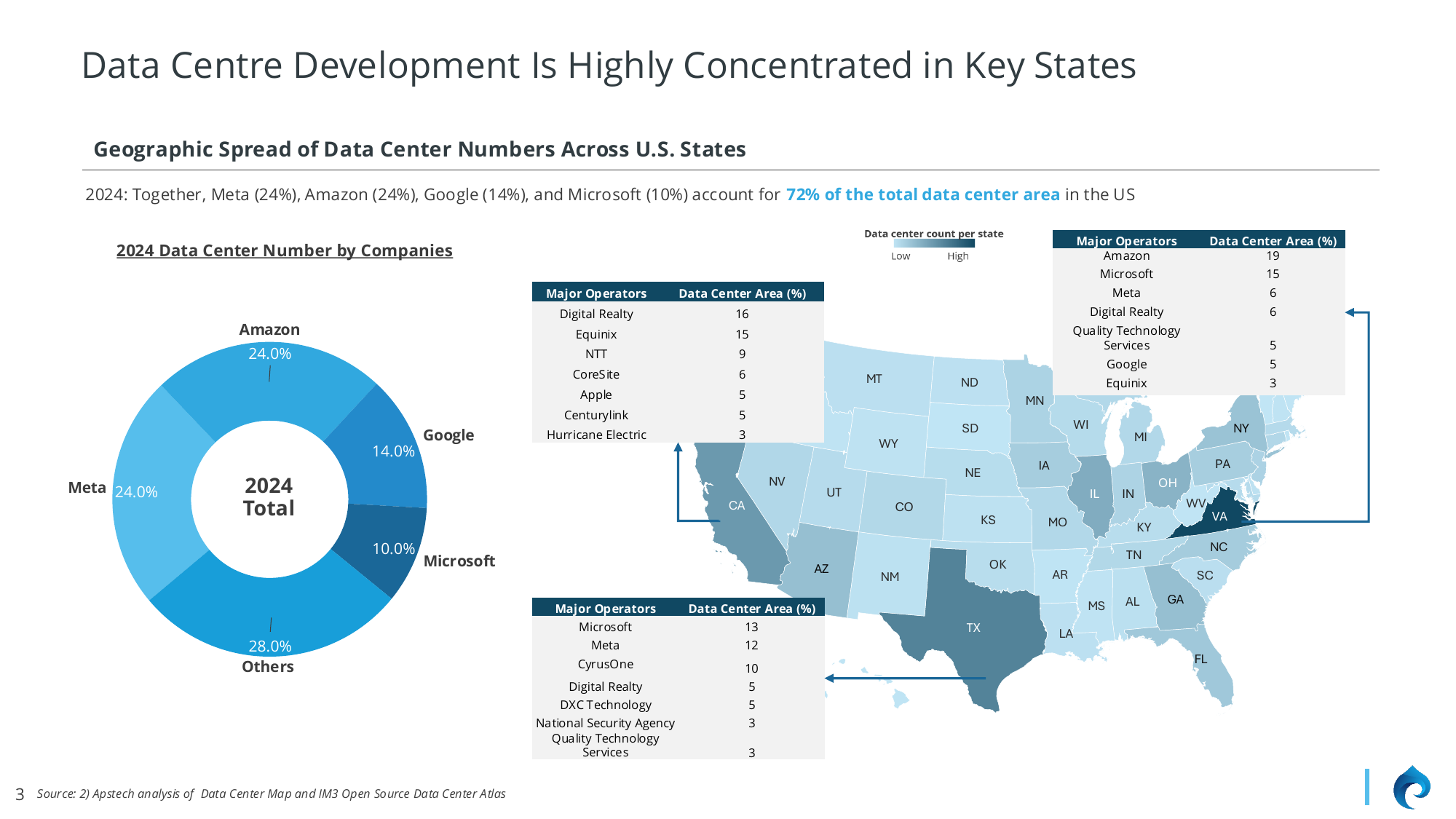

Market concentration. Meta, Amazon, Google, and Microsoft collectively control 72% of total US data center area. Virginia, Texas, California, and a handful of other states host the majority of these facilities, creating localized pressure on power grids and water systems.

Shift to hyperscale facilities. By 2023, hyperscale and colocation data centers accounted for 84% of direct water consumption. These facilities use more evaporative cooling and liquid-cooled AI systems, driving higher on-site water use per unit of IT energy.

What Is the Difference Between Direct and Indirect Data Center Water Use?

Understanding the distinction between direct and indirect water consumption is essential for addressing data center sustainability challenges.

Direct water use comes primarily from cooling systems. Evaporative cooling towers and adiabatic systems drive most of this demand. The direct water intensity for US data centers in 2023 was 0.36 liters per kilowatt-hour.

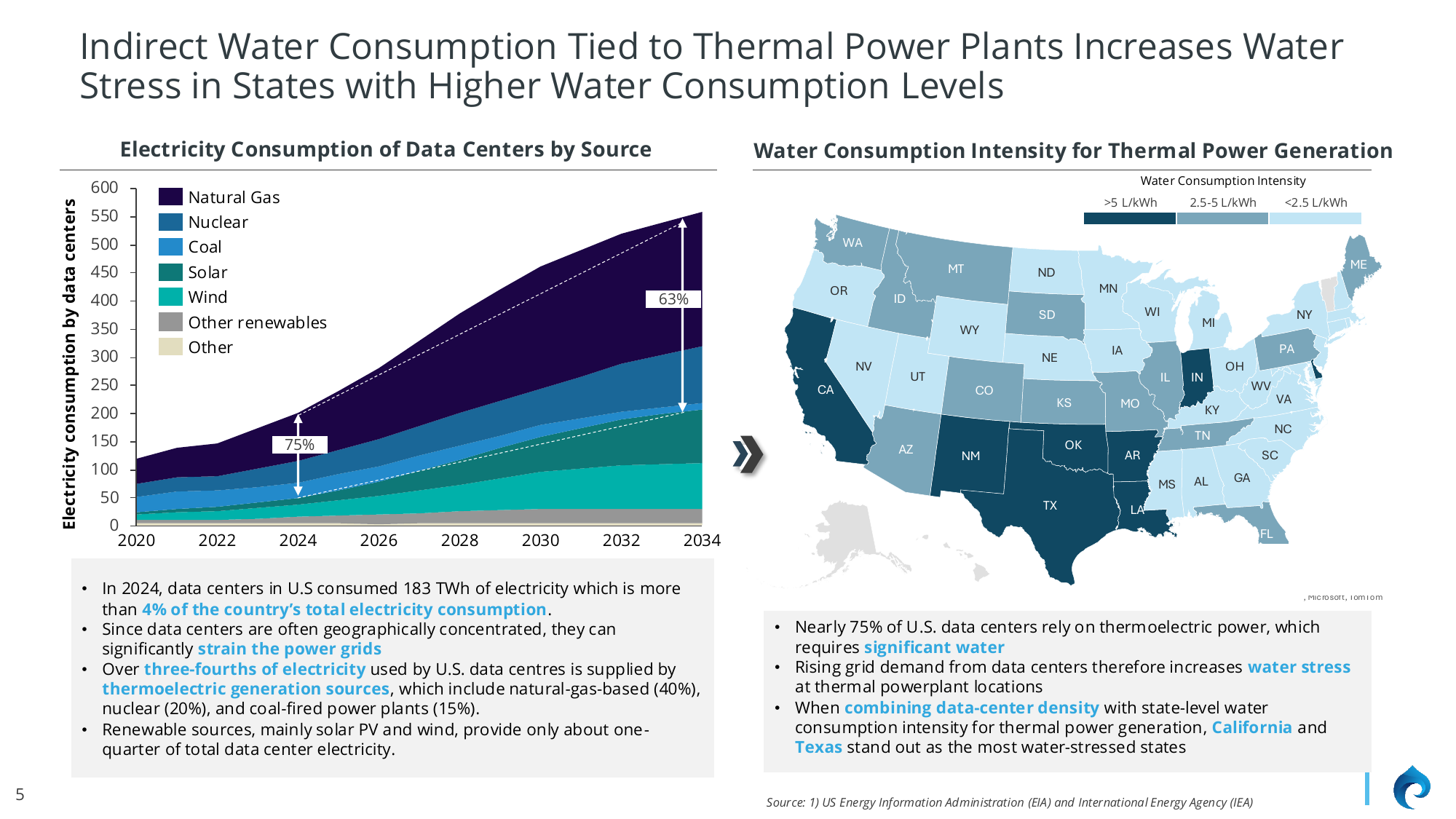

Indirect water use occurs at power plants generating electricity for data centers. Over 75% of US data center electricity comes from thermoelectric sources—natural gas (40%), nuclear (20%), and coal (15%)—all of which require substantial water for cooling. The indirect water intensity is 4.52 liters per kilowatt-hour, more than twelve times the direct rate.

Which States Face the Greatest Water Stress from Data Centers?

When mapping data center density against state-level water consumption intensity for thermal power generation, California and Texas emerge as the most water-stressed states. These are precisely the regions where data center demand is growing fastest.

The geographic concentration creates compounding challenges: data centers strain local power grids, which in turn increases water demand at thermal power plants, intensifying competition for water resources in already-stressed regions.

How Much Water Will Data Centers Use by 2030?

Global data center capacity will reach an estimated 223 GW by 2030, with the US and China together accounting for roughly three-quarters of that total. The US alone had 42 GW of installed capacity in 2024, projected to grow at approximately 16% annually through the decade.

Projections for water consumption reflect this growth:

- Hyperscale data centers are expected to consume between 60 and 124 billion liters of water annually by 2028

- The shift toward AI workloads and liquid cooling systems will increase per-facility water intensity

- Total direct water consumption will rise as hyperscale and colocation facilities absorb most of the nation’s IT load

What Technologies Reduce Data Center Water Consumption?

Several cooling and water management technologies are emerging to address data center water challenges:

Immersion cooling reduces water use by 90–95% compared to evaporative systems by submerging servers in thermally conductive liquid.

Closed-loop glycol systems eliminate evaporative water loss entirely and are expected to triple in deployment by 2030.

Air-cooled and chiller-based systems consume near-zero on-site water, though they typically require more electricity.

Water reuse systems enable facilities to recycle cooling tower blowdown. Microsoft’s $31 million Quincy facility demonstrates up to 80% blowdown reuse capability.

The tradeoff between direct water use and energy consumption creates strategic choices for operators: water-intensive evaporative cooling reduces electricity demand, while dry cooling technologies shift the burden to the power grid.

Market Opportunities in Data Center Water Management

For water technology providers, utilities, and investors, the convergence of digital expansion and water stress creates distinct market opportunities.

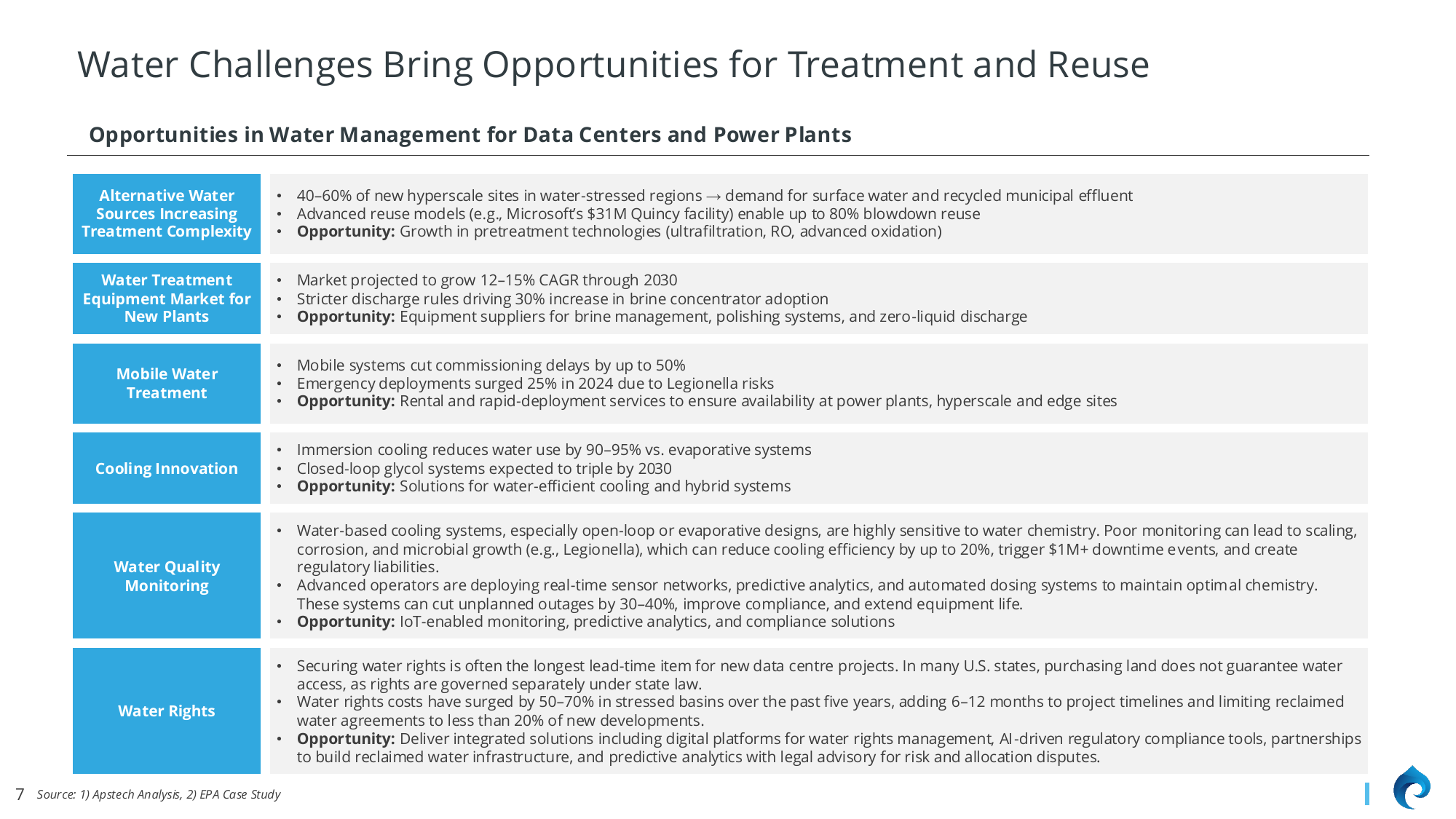

Alternative Water Sources and Advanced Treatment

An estimated 40–60% of new hyperscale sites in water-stressed regions are turning to surface water and recycled municipal effluent. This creates demand for pretreatment technologies—ultrafiltration, reverse osmosis, advanced oxidation—that can handle variable feedwater quality.

Water Treatment Equipment

The market for treatment equipment serving new data centers and power plants is projected to grow at 12–15% CAGR through 2030. Stricter discharge regulations are driving a 30% increase in brine concentrator adoption. Equipment suppliers with capabilities in brine management, polishing systems, and zero-liquid discharge are well-positioned.

Mobile Water Treatment

Mobile treatment systems can cut commissioning delays by up to 50%. Emergency deployments surged 25% in 2024, driven partly by Legionella risks at cooling towers. Rental and rapid-deployment services offer flexibility that hyperscalers value.

Cooling Innovation

Providers offering water-efficient cooling solutions and hybrid configurations are addressing clear market demand as operators balance water consumption against energy efficiency.

Water Quality Monitoring

Evaporative and open-loop cooling systems are highly sensitive to water chemistry. Poor monitoring leads to scaling, corrosion, and microbial growth—problems that can reduce cooling efficiency by 20% and trigger downtime events costing more than $1 million. Real-time sensor networks, predictive analytics, and automated dosing systems can cut unplanned outages by 30–40%.

Water Rights and Regulatory Navigation

Securing water rights is often the longest lead-time item for new data center projects. In many US states, purchasing land does not guarantee water access. Water rights costs have surged 50–70% in stressed basins over the past five years, adding 6–12 months to project timelines. Firms offering digital platforms for water rights management, AI-driven compliance tools, and regulatory advisory services provide genuine value.

What Should Utilities and Investors Know?

For utilities serving data center-heavy regions, this means planning for substantial new industrial customers with predictable but large water needs—and potentially partnering on reclaimed water infrastructure.

For technology providers, it means product development focused on efficiency, reliability, and the ability to work with alternative water sources.

For capital allocators, it means identifying companies positioned at the intersection of these trends—treatment equipment manufacturers, cooling technology innovators, monitoring and analytics providers, and firms with expertise in water rights and regulatory strategy.

The data center water challenge is significant. The opportunities it creates are proportional.

Frequently Asked Questions

How much water does a single data center use?

Water consumption varies significantly by cooling technology and climate. A typical hyperscale data center using evaporative cooling can consume 3–5 million gallons of water per day. Facilities using air-cooled or immersion cooling systems use substantially less direct water but may consume more electricity.

Are data centers bad for the environment?

Data centers have significant environmental footprints through both energy and water consumption. However, modern facilities are increasingly adopting renewable energy, water recycling, and efficient cooling technologies to reduce their impact. The environmental effect depends heavily on location, cooling technology, and power source.

What is PUE and WUE in data centers?

Power Usage Effectiveness (PUE) measures total facility energy divided by IT equipment energy—lower is better, with 1.0 being theoretical perfection. Water Usage Effectiveness (WUE) measures annual water usage divided by IT equipment energy, expressed in liters per kilowatt-hour. Industry-leading facilities achieve WUE below 0.5 L/kWh.

Which companies operate the most data centers in the US?

Meta, Amazon, Google, and Microsoft collectively control 72% of total US data center area. Major colocation providers include Digital Realty, Equinix, CyrusOne, and QTS (Quality Technology Services).

Will AI increase data center water consumption?

Yes. AI workloads are more computationally intensive than traditional cloud computing, generating more heat per server. This increases cooling demand. Additionally, the rapid expansion of AI infrastructure is accelerating overall data center growth, compounding water consumption trends.

References

- International Energy Agency (IEA). Data Centres and Data Transmission Networks. IEA Energy System Analysis, 2024. https://www.iea.org/energy-system/buildings/data-centres-and-data-transmission-networks

- Shehabi, A., Smith, S., Sartor, D., et al. 2024 United States Data Center Energy Usage Report. Lawrence Berkeley National Laboratory, LBNL-2001641, December 2024.

- U.S. Energy Information Administration (EIA). Electric Power Monthly.https://www.eia.gov/electricity/monthly/

- Data Center Map. Colocation Data Centers. https://www.datacentermap.com/

- IM3 Open Source Data Center Atlas. Infrastructure, Materials, and Markets (IM3) Project.

- U.S. Environmental Protection Agency (EPA). Water Recycling and Reuse: Case Studies.https://www.epa.gov/waterreuse

- Executive Order on Accelerating the Development of AI Infrastructure in the United States. The White House, January 2025.

Apstech Advisors supports accelerated water business growth through strategic advisory services.Explore Our Insights →

Related Topics: Data Center Sustainability Water Usage Effectiveness Hyperscale Data CentersCooling Tower Water Treatment Industrial Water Reuse Water Stress Mapping AI Infrastructure

Last Updated: January 2025